Avoid interest and penalties for unpaid taxes by talking to our experienced tax attorneys. We are your San Diego legal resource for tax law, business counseling, and employee benefits. If you have any questions about tax filing, tax strategies, or tax planning, Butterfield Schechter LLP is here to help.

The P&DC is located at 11251 Rancho Carmel Drive, San Diego, CA 92128. Sellers Processing & Distribution Center in Carmel Mountain Ranch accepts mail collection until midnight on tax day for last-minute returns. Check the closing time of your local post office to make sure your return is postmarked by April 18, 2016. However, these options may be limited the closer you are to tax time.įinally, you may be able to print out and paper file your tax return. You may also be able to contact the IRS directly by calling the telephone numbers listed on the IRS' website.

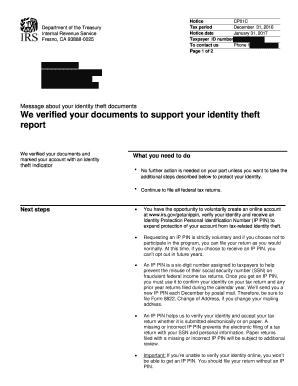

#Irs gov get an ipin professional

You can contact your tax attorney or other tax professional for advice. If you are unable to file your taxes because of a PIN rejection, you still have other options. If you do not already have an online account, you may be required to register and verify your identity to retrieve your IP PIN. To do so, use the IRS' Get an IP PIN online tool to retrieve your IP PIN. If you do not know your IP PIN number or misplaced it, you may be able to retrieve your IP PIN online. If you file a paper return without the IP PIN, the IRS may subject your return to additional screening, possibly delaying your refund. If you file your electronic return without your IRS assigned IP PIN, the IRS will reject your return. Had your e-file tax return rejected because you didn't include an IP PIN.Received a CP01A Notice with an IP PIN.An IP PIN is used to verify a taxpayer's identity in order for the IRS to accept their tax return. This is a 6-digit number assigned to eligible taxpayers to help prevent fraudulent tax filings. If you were a victim of identity theft, you may have been provided with a specific IRS Identity Protection Personal Identification Number (IP PIN). If one of the joint filers did not file last year, then they can enter 0 for their AGI. If you are filing jointly for the first time, you should enter the AGI for each individual for their prior tax year. If you are filing taxes for the first time and over the age of 16, you can enter 0 as your AGI. You may also be able to get an online transcript of your tax return by using the Get Transcript Online service through the IRS website. On a 2015 tax return, the AGI is on line 37 of the Form 1040, line 21 on the Form 1040-A, or line 4 on the Form 1040-EZ. If you do not know your AGI, you should be able to obtain it from a copy of your prior-year tax return. If your return was rejected because of an AGI or PIN error, double check to make sure you entered the correct number. If you are e-filing with the same company used the prior year, this information may be automatically entered. In order to validate your federal tax return, you must include your prior-year Adjusted Gross Income (AGI) or Self-Selected PIN.

“Your federal return was rejected because the taxpayer AGI or PIN you entered when you e-filed does not match IRS records.”Įvery year, thousands of tax filers get a rejection message like the one above after submitting their tax returns. Even after double-checking, you may be left confused wondering what to do as the tax filing deadline looms. However, a few hours later, you get a notice that your return was rejected because the PIN you entered was incorrect. Before you can submit your return, you are prompted to enter your PIN number. After spending hours of time plugging in numbers on a tax website or using tax-prep software, you are finally ready to submit your return.

0 kommentar(er)

0 kommentar(er)